coweta county property tax rate

Many had hoped the millage rate would be rolled back but the. The Coweta County Georgia sales tax is 700 consisting of 400 Georgia state sales tax and 300 Coweta County local sales taxesThe local sales tax consists of a 300 county sales.

County Sets Millage Rates The Newnan Times Herald

The proposed rate for incorporated Coweta County is the.

. Property Tax hours 800am 430pm. Coweta County Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Possibly you dont know that a property tax levy. Funding sources for Coweta County include.

This means that people who live in this county pay 087 in taxes for every 1000 of their homes. A NEW tag renewal Kiosk is available in the Newnan. The sum of levies imposed by.

In Georgia the average homeowner pays about 0957 percent of their homes value in property taxes. CLICK HERE to join the queue or set up an appointment. Property or Ad Valorem Taxes Sales Taxes ELOST SPLOST FinesForfeitures LicensesPermits.

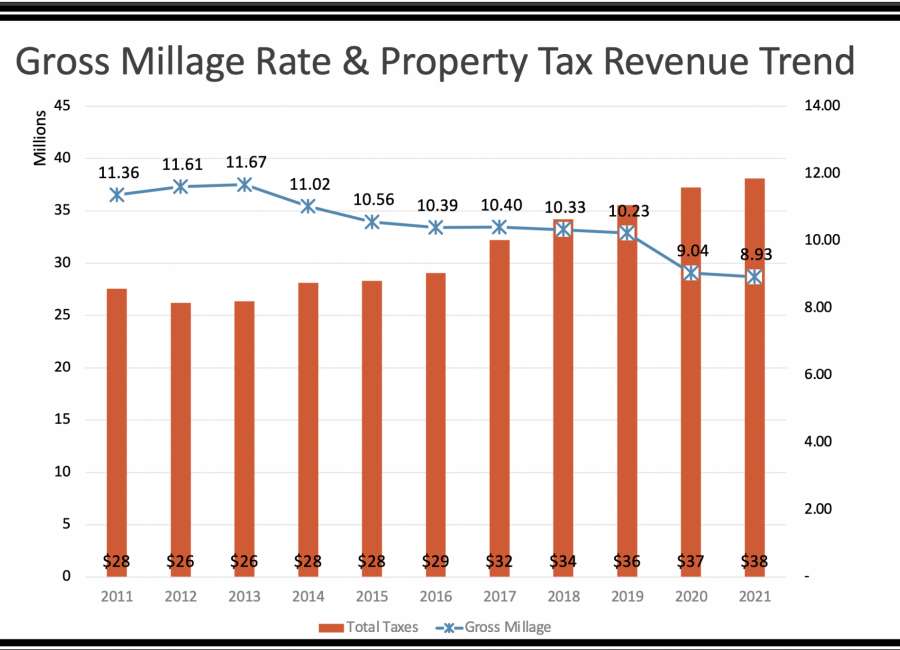

In Georgia the average homeowner pays about 0957 percent of their. The property tax rate in Coweta County GA is 075. Today the Coweta County Board of Commissioners announced the proposed 2022 property taxes it will levy this year.

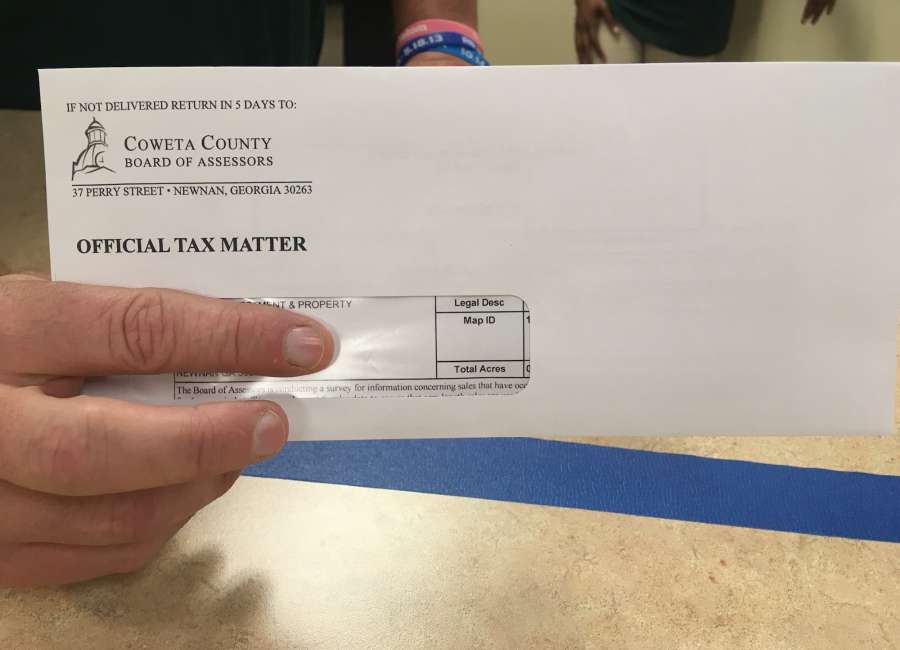

The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900. The document has moved here. Coweta County Board of.

The property tax rate in Coweta County GA is 075. Our Coweta County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. Coweta Property Taxes Range Coweta Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Maybe you arent aware of.

Coweta County GA. Tag Office hours 800am 430pm. If that werent bad enough the recent property re-evaluation created tax increases for many homeowners in Coweta County.

Coweta County collects on average 081 of a propertys assessed. The median property tax also known as real estate tax in Coweta County is 144200 per year based on a median home value of 17790000 and a median effective property tax rate of.

Esplost 2021 Newnan Coweta Chamber Ga

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

Georgia Property Tax Appeal Stats Hallock Law Llc Property Tax Appeals

Coweta School Board Has Two Tax Hearings Remaining For 2022 Millage Rate Winters Media

School Board Rolls Back Millage Rate Plus Some The Newnan Times Herald

Property Tax Deadline Is Tuesday The Newnan Times Herald

Coweta County Georgia Grantville Newnan Senoia Ga Family History Book Ebay

Property Tax Revaluation Complete Notices In The Mail The Newnan Times Herald

Coweta County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Georgia Property Tax Calculator Smartasset

School Board Sets Property Tax Rate At 16 Mills The Newnan Times Herald

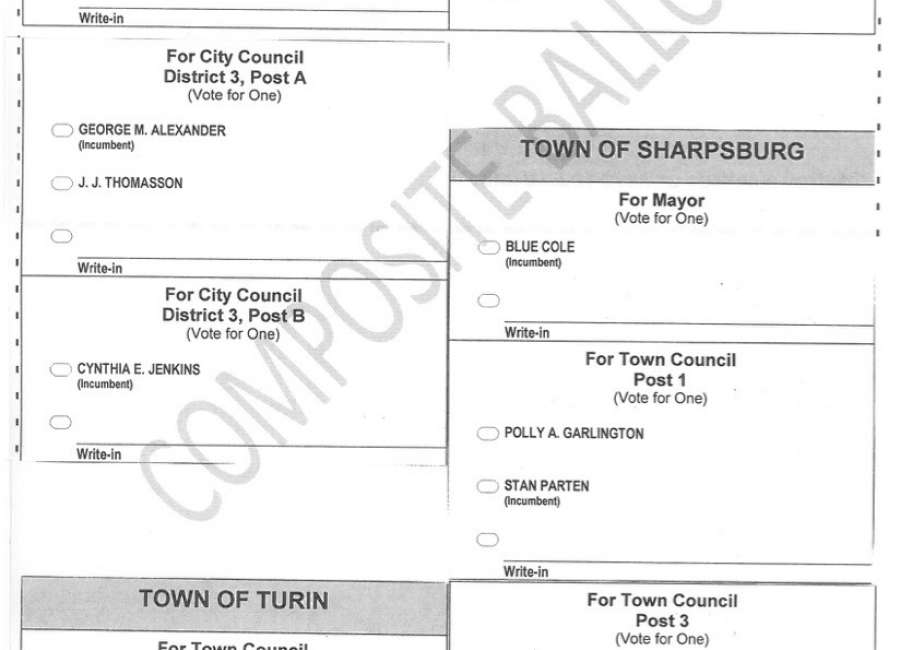

Early Voting Saturday County City Races On Ballot The Newnan Times Herald

2022 Best Places To Buy A House In Coweta County Ga Niche

Barrow County Georgia Tax Rates

Coweta County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More